We often hear about people getting big tax refunds and some tax refund companies advertise this so vigorously that it creates the perception that everyone on salary or wages is owed a tax refund by the IRD and can get it.

However this might not always be the case and if you have been issued a PTS (personal tax summary) or have requested a PTS which results in tax to pay. Well you have to pay it.

So how do can we reduce the chances of having to pay tax at the end of the tax year.

If you earn salary or wages or are on a benefit

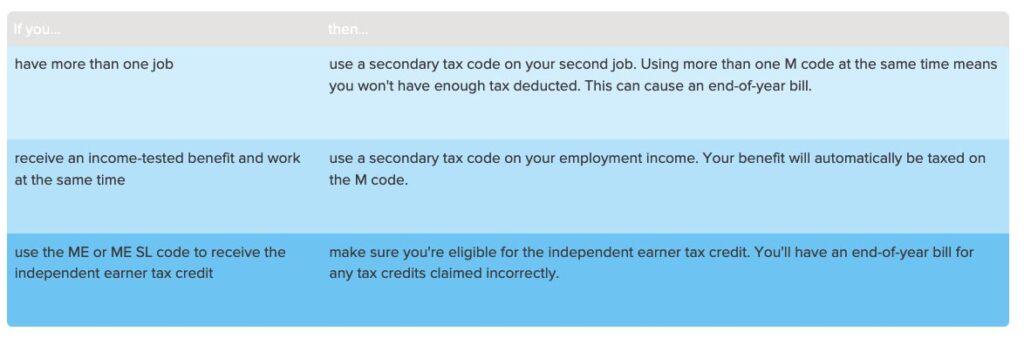

To reduce your chances of having a bill to pay next year make sure you use the right tax code. Your tax code is important because it helps your employer know how much tax to deduct from your income.

If you’re self-employed or earn business income

To reduce your chances of having a bill to pay next year plan ahead to pay your income tax. The amount of income tax you’ll have to pay is based on your net profit for the year. It’s a good idea to use a separate bank account to put money aside to cover the income tax you’ll need to pay.

If you pay provisional tax during the year make sure you use the right calculation option for your situation and make your payments on time.

If you follow the estimation option, be careful when estimating the amount you pay. Remember to re-estimate whenever your income or situation changes.

If you aren’t required to pay provisional tax, your income tax assessments will always come at the end of the year.

Having trouble paying your provisional tax or you always have a large tax bill at the end of the financial year? Contact us for a discussion on how we can help you sort out your tax issues.

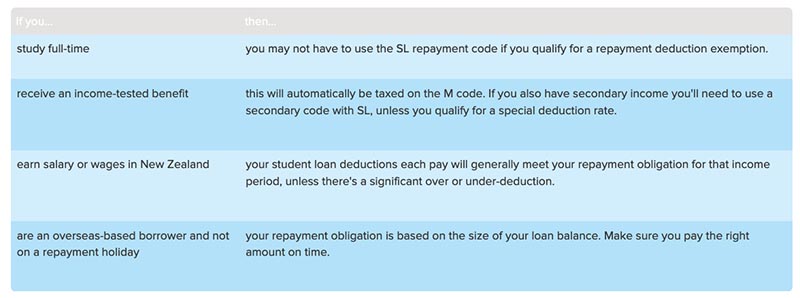

If you earn income that’s not from salary or wages and have a student loan

You need to make other payments towards your loan if your income isn’t from salary or wages. You’ll need to work out your repayments if you have adjusted net income requiring IR3 income tax return or a personal tax summary.

If you receive Working for Families Tax Credits

To reduce your chances of having a bill to pay next year make sure you only receive the tax credits you’re entitled to. If your income is uncertain, consider receiving your entitlement as one lump sum at the end of the year instead of weekly or fortnightly.

If you have income from multiple sources or have investments income its best to seek professional advice.