GST is imposed and administered by the Goods and Services Tax Act 1985. GST was introduced in New Zealand on 1 October 1986 at a rate of 10% on most goods and services. It replaced existing sales taxes for some goods and services. Since then GST has had two increases, on 1 July 1989 the rate increased to 12.5% and on 1 October 2010 it increased again to 15%.

How it works

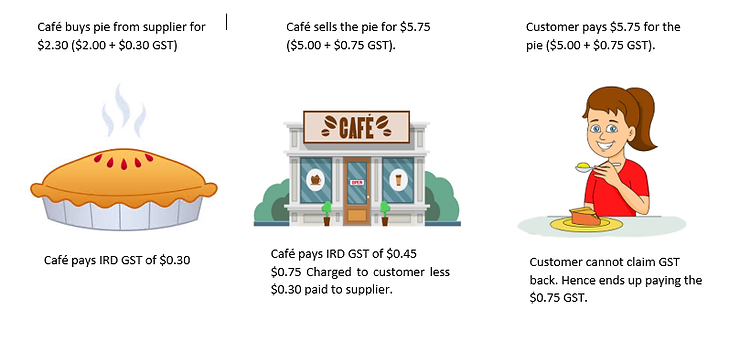

Goods and Services Tax is a value-added tax or consumption tax for goods and services consumed in New Zealand.

Businesses collect GST on their sales and pay it on their purchases from other businesses. This is done throughout the supply chain until the goods/service reach consumers. Consumers ultimately pay the entire cost of GST.

When do you need to register for GST

To register for GST you need to be running a business which carries out a taxable activity and your turnover was at least $60,000 in the last 12 months or you expect it to be $60,000 or more in the next 12 months. GST applies to all kinds of business weather you are a sole trader, partnership, trust or just working as a contractor. It does not apply to people in employment.

You must also register for GST if you add GST to the price of goods or services you sell, regardless of your turnover exceeding the $60,000 registration threshold.

This blog is part of our small business basic accounting and New Zealand tax series aimed to refresh your understanding of basic tax rules.