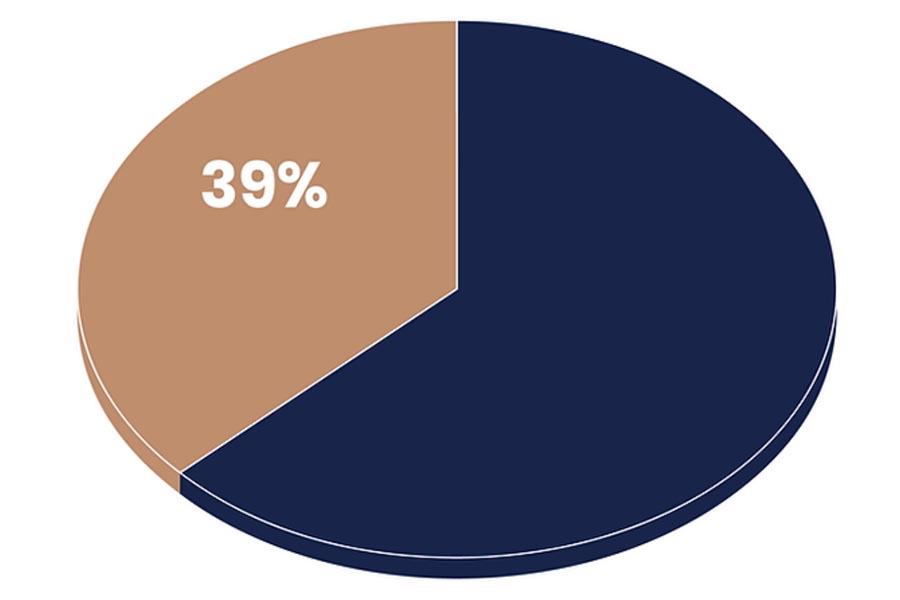

The new tax rate for those that earn more than $180,000 NZD annually comes into effect from this month (April 2022). This tax bracket lies 11% above the rest at a 39% tax rate.

Besides being a form of sustaining economical loss within New Zealand and maintaining government revenue after the Covid-19 pandemic, the government has also placed its reasoning for this increase on its efforts in ensuring a “fair and progressive” tax system where everyone “pays their fair share of tax”.

The problem however is, the integrity of the 39% personal tax rate. The government is particularly concerned about the taxpayers who are avoiding the 39% personal tax rate using trusts and companies to earn their income, obtaining the 33% tax rate instead. The effects of this situation on the economy have also been outlined in a government discussion document and go severely against the government’s intentions of implementing this new tax bracket.

However, the good news is that the government is aware and has been actively reviewing solutions regarding supporting the integrity of the 39% personal income tax rate. There are three proposed solutions included in this document, which address and seek to improve the problem we have at hand. It has proposed:

- Sales of shares of a company by the controlling shareholder being treated as giving rise to a dividend to the shareholder to the extent that the company and its subsidiaries have retained earnings. Additionally, there will also be an ASC (available share capital) increase which both address “current inequity in the imputation credit continuity rules” and prevents double taxation from occurring upon liquidation.

- Required on a prospective basis to maintain record of their ASC and net capital gains.

- The “80 percent one buyer” test for the personal attribution rule be removed.

Becoming informed about current and future changes relating to your tax environment is important. Understanding how these changes impact you and your organization and what you need to do in order to be compliant is essential.

If you have an opinion on how these changes will affect you, you can read the discussion document and email your submissions to policy.webmaster@ird.govt.nz

If you are concerned about how to plan for these changes, contact us.