There are a number of statutory deductions an employer has to make from their employees pay. These are shown on the employees payslip. Below we discuss some of the common deductions and how they are calculated.

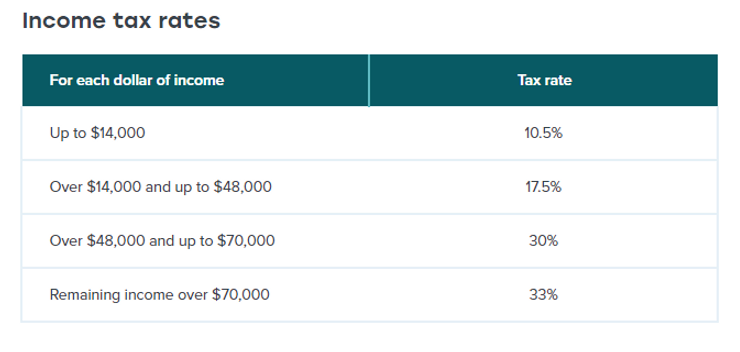

· PAYE (Pay as you earn) – is deducted on every dollar your employee has earned. If your employee did not submit their tax code declaration form IR330 it will be your responsibility to deduct PAYE at the non-notified rate. The non-notified rate is 46.39 cents in the dollar (including ACC earners levy). Use tax code ND for the non-notified rate. If, however, they have submitted their tax code declaration form you have to use the tax coded declared unless advised by the IRD otherwise. The final tax you employees pay will depend on their annual income. This can be calculated based on the table below:

Example: This example shows how the final tax will be calculated.

If your employee Zia earns $20.00 per hour at 40 hour per week, her final tax is calculated as per below:

- Rate per hour $ 20.00

- Multiply by: hours per week 40.00

- Gross pay per week $ 800.00

- Multiply by number of weeks per year 52.00

- Gross pay per year $41,600.00

| Income tax rate | Income | Tax |

| Income up to $14000.0000, taxed at 10.5% | 14,000.00 | 1,470.00 |

| Income over $14000 and up to $48000, taxed at 17.5% | 27,600.00 | 4,830.00 |

| Income over $48000 and up to $70000, taxed at 30% | 0.00 | 0.00 |

| Remaining income over $70000, taxed at 33% | 0.00 | 0.00 |

| 41,600.00 | 6,300.00 |

- KiwiSaver – these are voluntary deductions paid toward employee’s retirement. If the employee is not yet registered for Kiwisaver you need to register them even if they have opt out. The Kiwisaver rates are 3%, 4%, 6% and 8%. If an employee opted in, as an employer you need to pay the KiwiSaver Employer Contribution.

- Student Loans – if your employees have student loans, repayments will be deducted based on their income. Your employees and/or the Inland Revenue may request to deduct extra payments.

- Child Support – IRD will send you a notification if you will need to deduct child support for your employee.

- Payroll Giving – are basically donations. Your employee can opt to give to an approved charity. They can then claim back at least $0.33 for every dollar of payroll giving.

IRD offers a wide range of calculators including the payroll calculator. You may give it a try here

This blog is part of our small business basic accounting and New Zealand tax series aimed to refresh your understanding of basic tax rules.