Running a business brings constant decisions. Sales, staffing, cash flow! Tax often slips into the background until a deadline looms or a letter arrives. At that point, many owners type “tax advisor near me” into a search bar and hope for quick answers.

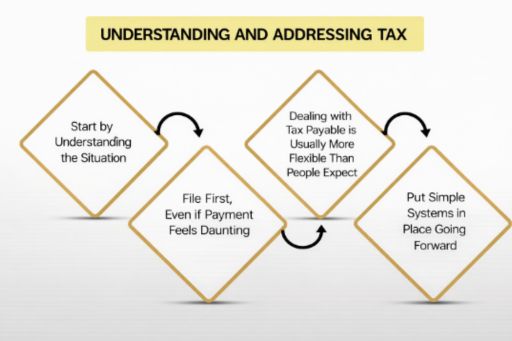

The truth is, good tax advice works best before problems appear. Early guidance helps you plan, not panic.

Why Business Taxes Feel More Complex Than Ever

Business owners face a changing tax environment. Rules around GST, provisional tax, shareholder salaries, and business structures create layers of responsibility. Add online sales, overseas clients, or digital services, and the picture grows more complicated.

You might relate to thoughts like:

- Am I paying more tax than necessary?

- Have I set up my company structure the right way?

- What happens if Inland Revenue reviews my returns?

These questions signal that professional support could add real value.

Key Moments to Look for a Tax Advisor

Certain business stages make expert tax input especially important.

- Business growth

Revenue increases often push businesses into new tax brackets or GST obligations. A tax advisor reviews whether your systems, structure, and provisional tax approach still fit your situation.

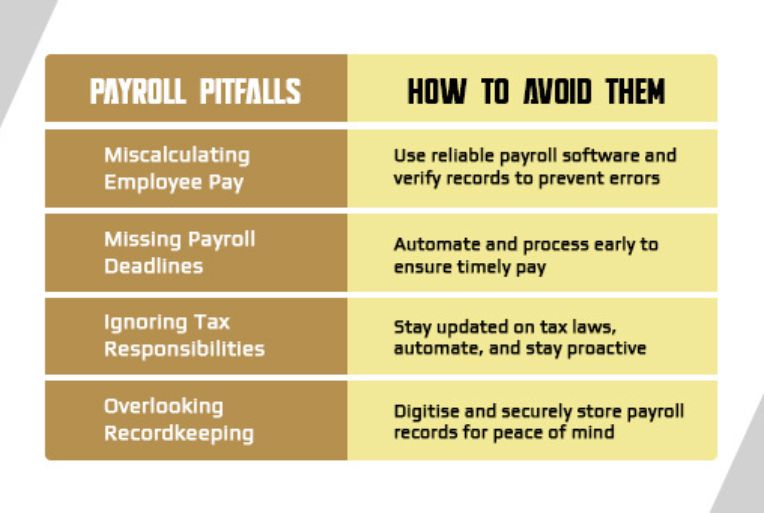

- Hiring staff or contractors

Payroll taxes, KiwiSaver, and contractor classification rules carry compliance risks. Getting this wrong leads to penalties and back payments.

- Buying or selling assets

Property, vehicles, and equipment purchases affect depreciation and tax deductions. Timing and structure matter.

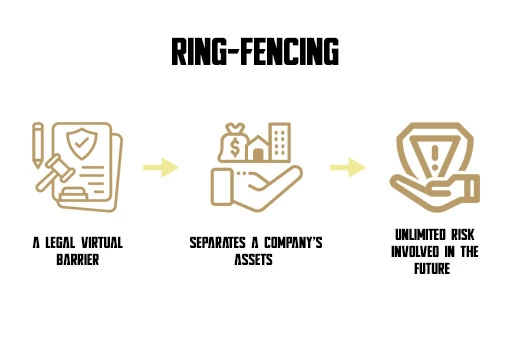

- Business restructuring

Changing from sole trader to company, adding shareholders, or creating a trust has long-term tax effects. Advice at this stage prevents costly mistakes later.

What a Tax Advisor Actually Helps You Do

A qualified advisor does more than prepare returns. They help you understand the “why” behind the numbers.

You gain support with:

- Tax planning to manage cash flow and provisional tax

- Identifying legitimate deductions and credits

- Structuring income in a tax-efficient, compliant way

- Preparing for Inland Revenue queries or reviews

- Making informed decisions before major financial moves

This forward-looking approach reduces stress. You stop reacting and start planning.

Local Knowledge Matters in New Zealand

Searching for a tax advisor is about more than location. It is about finding someone who understands the New Zealand tax system in detail. Inland Revenue expectations, GST rules, and industry-specific treatments differ from those in other countries.

An advisor who works regularly with New Zealand small and medium businesses understands local reporting standards, common audit triggers, and sector-specific issues. That insight helps you stay compliant while keeping your business financially healthy.

FAQ About Hiring a Tax Advisor

- When should a small business hire a tax advisor?

As soon as your business earns a steady income, hires staff, or registers for GST. Early advice prevents long-term errors.

- Is a tax advisor only needed at year’s end?

No. Ongoing advice throughout the year helps with planning, budgeting, and major decisions before they affect your tax position.

- How is a tax advisor different from a bookkeeper?

A bookkeeper records transactions. A tax advisor interprets those numbers, provides planning strategies, and ensures compliance with tax law.

Bottom Line:

Business owners carry enough pressure already. Clear tax guidance removes uncertainty and supports better decisions. Elite Accounting Limited – Chartered Accountants works with small to medium businesses that want practical, professional tax advice grounded in real-world experience and a strong understanding of local regulations.