So, you’re starting your small business! That’s wonderful!

The freedom to make your own decisions, build a brand that truly reflects you, and connect with your customers personally it’s all exciting, and that feeling is completely normal.

But behind that excitement lie the real challenges.

Cash flow management, financial planning and budgeting, team and payroll management, and strategic planning…all can turn into a nightmare if not handled properly.

Among these, payroll processing stands out as one of the most critical functions for any business. A single mistake can lead to compliance violations, employee dissatisfaction, hefty fines, and more.

So, what’s the solution?

Hiring a seasoned accountant near you can make all the difference. They ensure timely and accurate payments, keeping your business safe from costly penalties and legal issues.

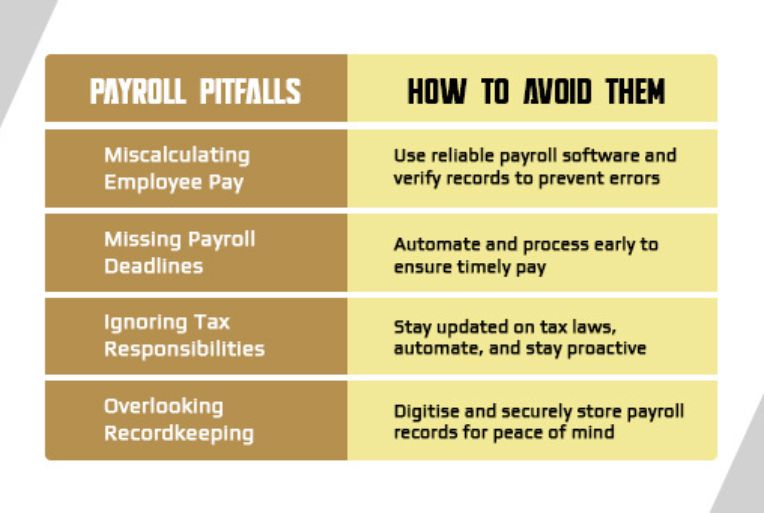

In this blog, we’ll walk through some of the most common payroll mistakes every business owner should know and how to avoid them.

- Miscalculating Employee Pay

One of the most common payroll problems is paying employees incorrectly. It may seem like a small slip, like a few missed hours here, an incorrect overtime rate there. But these errors can shake employee confidence and hurt team morale.

Smart fix:

Invest in dependable payroll software and keep employee pay records current. Always double-check data before finalising payments. A few extra minutes of review can save hours of damage control later.

- Missing Payroll Deadlines

Nothing affects team trust faster than delayed paychecks. Late payments can disrupt employees’ personal plans and even put your business at legal risk.

Keep it on time:

Set automated reminders, process timesheets ahead of payday, and plan around holidays. Paying your team on time might seem basic, but it tells them that you respect and care about them.

- Ignoring Tax Responsibilities

Tax errors are like slow leaks! They start small but can cause major problems later. From missed filings to incorrect withholdings, the damage adds up quickly.

Stay tax-ready:

Keep track of current tax laws and filing deadlines. Automate wherever possible, and never assume last year’s rates still apply. A proactive approach today prevents panic later.

- Overlooking Recordkeeping

Messy payroll records can cause headaches during audits or employee disputes. Missing pay slips, outdated records, or lost documentation can make your business look disorganised, even if your intentions are good.

Keep your books clean:

Digitise everything. Store payroll data securely for at least 3–5 years and review it periodically. Think of recordkeeping as insurance for your peace of mind.

The Role of Elite Accounting Limited – Chartered Accountants

Managing payroll is complex! But it doesn’t have to be stressful. Elite Accounting Limited – Chartered Accountants takes the pressure off your shoulders by handling every detail of your bookkeeping and payroll with precision and care. Their team ensures accurate calculations, timely payments, and full compliance with tax laws.

Whether you’re a growing startup or a small business owner juggling multiple roles, we provide personalised support that fits your needs. Our proactive approach helps you save time, reduce costly mistakes, and focus on what truly matters.

Final Thoughts:

Business success isn’t only measured in profits, but in the people who stand behind those numbers. And payroll sits right at that intersection. When your team gets paid accurately and on time, it builds loyalty, trust, and long-term commitment.

But let’s be honest! Managing payroll isn’t easy. Between tax updates, deadlines, and compliance rules, even the most organised business owners can feel overwhelmed. That’s where having the right experts by your side makes all the difference.

With Elite Accounting Limited – Chartered Accountants, you don’t just get numbers done right…you get peace of mind. Their team of expert accountants brings precision, professionalism, and genuine care to every detail, so you can focus on growing your business while they handle the rest.

Because when your payroll runs smoothly, everything else in your business follows with confidence and calm.

Frequently Asked Questions

- What if I make a payroll mistake?

Fix it quickly and communicate openly with your team. Then review your process or work with an accountant to prevent it from happening again.

- How can small businesses simplify payroll?

Use reliable software, keep employee info updated, and let professionals like Elite Accounting Limited – Chartered Accountants handle the complex stuff.

- Is outsourcing payroll worth it?

Yes. It saves time, reduces errors, and keeps you compliant while you focus on running your business.