As an ambitious business owner, do you know which factors drive business success? They are growth, profitability and operation efficiency. Among the factors that make such success possible is tax and financial management. These two are the significant pillars that any business needs for its survival, without which even a promising venture might fail. This is where the importance of consulting an experienced tax accountant comes in. With all their experience, accountants manage not just the numbers but also guide businesses into making informed decisions.

Tax Accountant’s Role for Small and Medium-Sized Business

For SMEs operating in New Zealand’s intricate web of financial regulations and taxation, tax accountants are irreplaceable. They are beyond mere compliance; they are strategic advisors who help businesses streamline things and achieve stability. They ensure accurate preparation of financial statements and even leverage tax planning strategies that enable you to focus on growth and avoid any financial mishaps.

Here are four key ways accountants help business owners make better decisions:

1. Simplifying the Start-Up Process

Starting a business can be an overwhelming process. However, tax specialists make the whole process easier. They prepare and analyse monthly financial statements with extreme accuracy. This gives business owners a clear picture of their financial health. That, in turn, helps to make data-driven decisions. The ability to rely on up-to-date financial data allows for effective planning and strategic adjustments.

2. Compliance With Regulations and Reporting

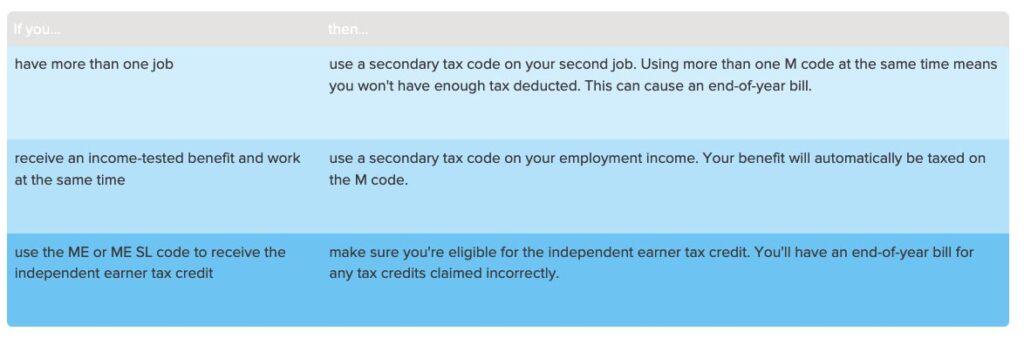

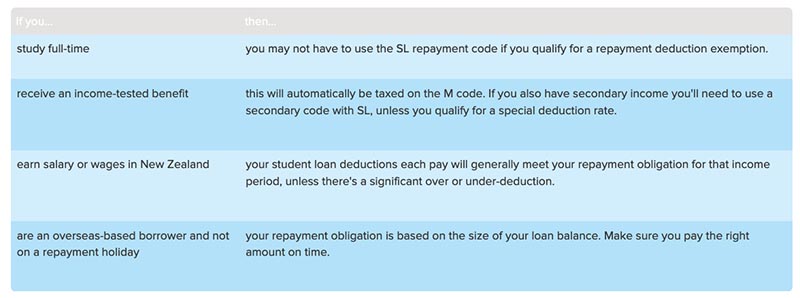

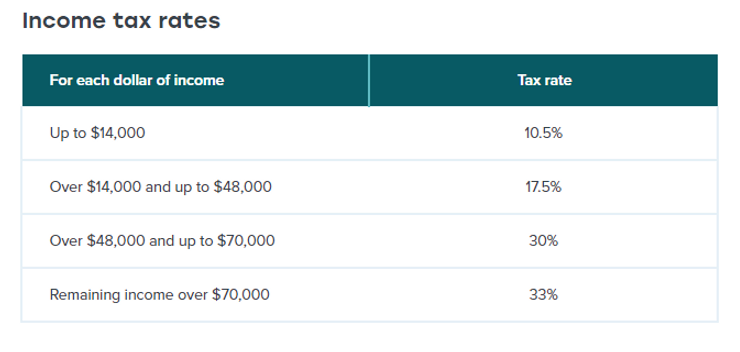

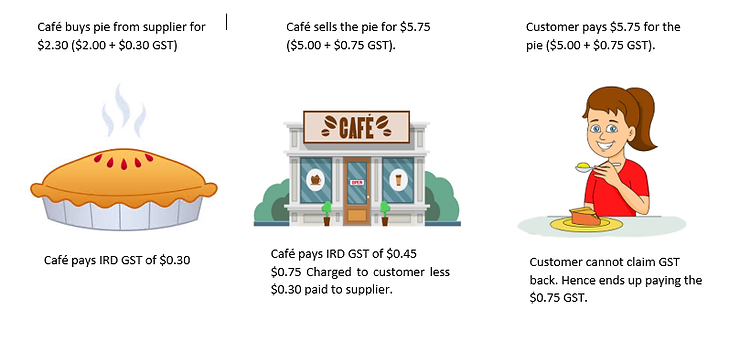

Compliance with New Zealand regulatory requirements is also time-consuming but essential. Tax accountants in New Zealand help businesses maintain compliance by correctly preparing and lodging financial reports, tax returns, and other compliance documents. It minimises the risk of incurring penalties while keeping a good standing with regulatory authorities.

3. Avoid Costly Financial Mistakes

Bookkeeping or tax errors can be devastating, especially for SMEs and startups. Accountants identify potential risks, correct errors, and institute strong financial systems that ensure you do not repeat the same mistake. Their vigilance and expertise help your organisation with both time and money.

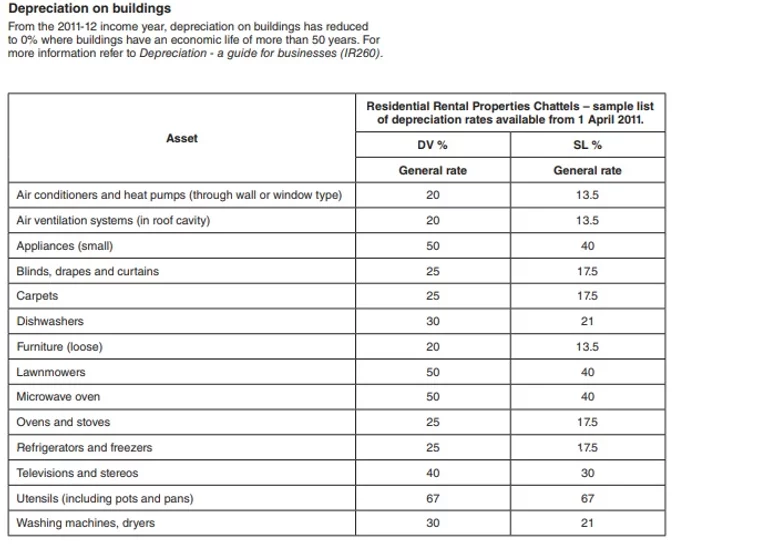

4. Tax Reviews and Audits

Tax reviews and audits must be periodic to identify discrepancies or missed opportunities in financial management. Tax professionals, on the other hand, conduct evaluations in detail that ensure compliance and help you to optimise tax returns. This way, businesses can reclaim funds they might have otherwise foregone.

The Final Thoughts

The work of tax accountants is not only about crunching numbers. They are your strategic partner to help your business achieve the growth and success it deserves.

If you are looking for superior accounting services in New Zealand, one name is trusted by all. It is that of Elite Accounting Limited – Chartered Accountants. Specialising in providing tax advisory for small and medium-sized businesses, our team of tax return accountants can help you with comprehensive year-end tax calculations with tailored accounting solutions. Whether you need a tax specialist or a small accountant for your business, we will assist you in every possible way to help you meet all your financial needs and achieve your goals.

Browse our website or contact us now for a consultation!