-

Why Should You Work With an Accountant From Day One: A Complete Guide for Entrepreneurs

“Why do I need to employ a full-time accountant? It’s just a start-up company. I can handle it alone!” Isn’t it the same thing you are thinking right now as an entrepreneur? And, you are […]

read more -

From Miscalculations to Missed Deadlines: The Most Common Payroll Pitfalls & How to Avoid Them

So, you’re starting your small business! That’s wonderful! The freedom to make your own decisions, build a brand that truly reflects you, and connect with your customers personally it’s all exciting, and that feeling is […]

read more -

Ring‑Fencing Rental Losses in NZ: What Business Owners Need to Know

What happens when your rental losses stop saving you on tax? Think about it… You bought a rental property thinking the losses would help slash your income tax bill! Smart move, right? But now, those […]

read more -

Best Accountant for Small Business: Top Mistakes to Avoid When Choosing One

Have you ever felt confused about choosing the right accountant for your small business? Do you worry about making a mistake that could cost you time as well as money? Finding a good accountant is […]

read more -

The Role of Accountants: 4 Ways They Help NZ Business Owners Make Better Decisions

As an ambitious business owner, do you know which factors drive business success? They are growth, profitability and operation efficiency. Among the factors that make such success possible is tax and financial management. These two […]

read more -

Goodbye Tax Headaches: Team up with the Best Small Business Accountant

Starting a small business? Are you hiring a business accountant? You will probably say, “Of course, not!” to cut down costs at the startup. Also, there are so many apps and business accounting software available […]

read more -

Unlocking the Power of Bookkeeping And Accounting for StartUps

Being the proprietor of a startup company, you need to take charge of all the facets relating to your organization. As you are a startup or a newbie in the domain, it is vital to […]

read more -

5 Considerations to Choose an Ideal Small Business Accounting Firm

Don't stress yourself handling accounting and tax-related matters for your business! Instead, hire a small business accounting firm. See how to find an ideal one.

read more -

Fundamentals of Business Accounting That New Business Owners Must Learn

Understanding your company’s financial health is critical as it helps make intelligent business decisions. Unfortunately, accounting is not every entrepreneur’s top skill, and many fail to get into the nitty-gritty of their organisations’ financial records. […]

read more -

How Important Is It to Consider Accounting and Tax Service for Your Small Business?

When it comes to operating a small business in New Zealand, it is evident that managing the financial aspect of the business can be a daunting task for small business owners. In an effort to […]

read more -

New disclosure rules for New Zealand trusts

The Taxation (Income Tax Rate and Other Amendments) Bill was passed last year, and this required increased disclosure from Trusts. These changes have been made to improve the transparency of trusts and their financial positions. […]

read more -

End of Financial Year Checklist

The period after 31st of April of every year can be both nerve wrecking and a relief as the end of the financial year is met. Sole traders and companies will hustle and bustle to […]

read more -

Looking for a Customisable Accounting Solution? Get Xero Now!!

Unless you want Inland Revenue (IR) audits and consequences, you know you are bound to do it. Without it, you never will be in control of your company’s financial state. Besides, your decisions and assessments […]

read more -

Benefits Of Using Xero For Your Small Business

Cloud accounting is the form of bookkeeping your business online. This means that all records, expenses, assets, liabilities, and various details are all kept online within one platform or software. Software like Xero is an […]

read more -

What Is Tax Debt, and How Can You Dig Your Way Out of It?

Every year many New Zealanders end up in debt to the Inland Revenue (IR) Department due to underpaying or underreporting their tax liabilities, whether on purpose or by mistake. Owing the Inland Revenue can be […]

read more -

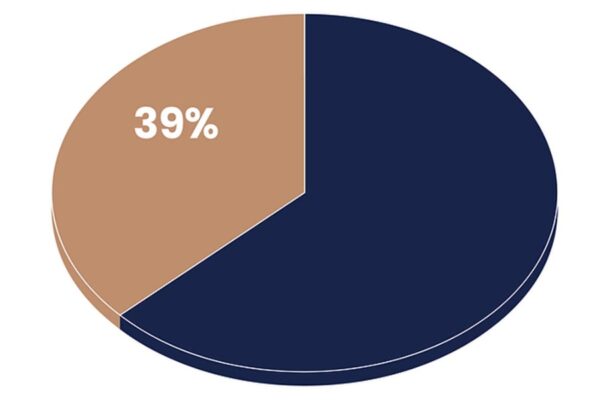

Maintaining The New Top Tax Rate

The new tax rate for those that earn more than $180,000 NZD annually comes into effect from this month (April 2022). This tax bracket lies 11% above the rest at a 39% tax rate. Besides […]

read more -

New Rules on Residential Rental Property Interest Deductions

Parliament has finally (on 29 March) passed legislation removing the ability of residential property investors to claim mortgage interest as a tax-deductible expense on existing properties. It is now just awaiting the formality of royal […]

read more -

Maintaining Your Business During a Global Pandemic

Before the COVID-19 pandemic, owning a business was hard enough. Now that we are living effected by a virus, maintaining a business has become even harder. We are faced full of uncertainties and for businesses, […]

read more -

Running a successful practice in New Zealand utilizing technology

Managing a successful private practice in New Zealand can be difficult at times, especially when covid is present. Here are some tips on how to run a successful practice in New Zealand utilizing technology. Dr […]

read more -

Are You Investing in Cryptocurrency? Know the Tax Obligations First

About a decade ago, most of us were unaware of cryptocurrency and blockchain. However, the recent boom of utilising blockchain to develop various types of cryptocurrencies has gained much attention from institutional and retail investors. […]

read more -

ACC Attendant Care Payments

ACC attendant care payments are payments made by ACC to any injured claimants for any services supplied by caregivers, either contracted or independent of the claimant’s choice. These payments that ACC now grant are treated […]

read more -

Business Support During COVID-19 Omicron Outbreak

The Government has announced 3 additional forms of financial support for businesses with cashflow pressures as a result of COVID-19. These are: an increase to the base Small Business Cashflow Scheme (SBCS) and the ability […]

read more -

A Deep Dive into Depreciation

Businesses require different resources to be able to provide the goods and services it offers. These resources are considered assets for they are beneficial to the business’s success. However, as time passes, these assets wear […]

read more -

The Importance Of Accounting For Small Businesses To Deal With Tax Returns

In order to evaluate the financial performance of a firm, Accounting has the highest importance as it helps investors, owners, shareholders to make decisions. Accounting provides the stakeholders with the perfect tool to analyze profit […]

read more -

Useful Tips to Hire Best Accounting Company in NZ

It’s a good idea to hire an accountant as soon as you decide to start your company. A skilled accountant will assist you in correctly setting up your accounting and payroll systems. In the long […]

read more -

Top 5 Benefits of Hiring a Chartered Accountant

Every business needs the right professional to deal with financial matters at ease. Having an experienced Chartered Accountant (CA) in your team can help you to drive success in any business, be it small or […]

read more -

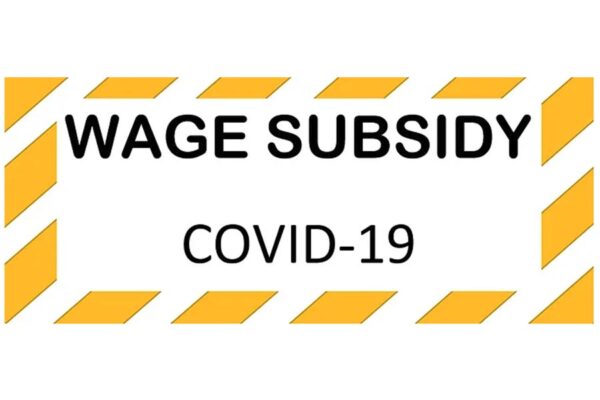

Wage Subsidy, Resurgence Payments – Eligibility and How to Apply

The current COVID outbreak and lockdown from 17th August 2021 have triggered government support payments for eligible businesses. Below we detail the support available and how you can access these. Wage Subsidy Scheme (Applications open […]

read more -

Top Five Reasons Small Businesses Need an Accountant

Small business owners prefer to thrive in a DIY environment. But the reality is the more hat they will wear, the less jobs they may complete successfully. Accounting is one of the most critical areas […]

read more -

Why Should You Hire the Services of a Small Business Accounting Company?

To run a business in an effortless way, you need to have teams of the most efficient and trusted professionals, who can look after all the important aspects of the business. Any business runs on […]

read more -

Residential Property Investment – Proposed Changes

Last week some major changes affecting residential property investments were announced by the Government. This article provides a brief overview of these proposed changes. Extension of the bright-line test from 5 to 10 years on […]

read more -

COVID-19 Resurgence Support Payment (RSP)

Applications are now open for the resurgence support payment. These payments are for businesses which have suffered a drop in revenue due to a COVID alert level increase to level 2 or higher. The resurgence […]

read more -

Manage Your Business in a Smarter and Better Way with Top Accountants

The basics of any business lie in monetary transactions. Maintaining a detailed and accurate record of these transactions is very crucial. And hence, accounting is a major and an integral part of every business. To […]

read more -

Parental Leave

If you or your spouse or partner having a baby, you might be able to take parental leave. In this article, we will discuss the following: Commonly used terms Employee Eligibility Types of parental leave […]

read more -

Top 3 Benefits of Hiring Professional Accounting Firms

Every business needs professional accounting services. But there are many who attempt to manage their accounting workflows by themselves or use an unqualified accountant. The result? Most tend to fall short of the outcomes they […]

read more -

Government Extends Small Business Cashflow Loan Scheme

The government has announced that it will extend the Small Business Cashflow Loan Scheme by 3 years. This means that businesses can access the Small Business Cashflow Loan Scheme until the end of 2023. Loans […]

read more -

Starting a Company in New Zealand

Congratulations, as if you are reading this you either have made the brave move to be your own boss or are seriously considering it. As far as business structures go small companies in New Zealand […]

read more -

IRD Collecting Data From Crypto Exchanges

The Inland Revenue Department is collecting investor data from Crypto Exchanges. It has requested exchanges such as Easy Crypto to provide data such as customers personal details and the type and value of their digital […]

read more -

Provisional Tax Calculation Options

Currently there are 4 options of calculating provisional tax. (Not sure what provisional tax is? Read our blog Provisional Tax here). The 4 options are briefly explained below. Standard Option This is the default option […]

read more -

Medical Accounting Services

Life is never slow when you are in the medical profession. You are so busy taking care of others that you barely get time to sort out your own paperwork and to make sure that […]

read more -

Provisional Tax

You might have heard of the provisional tax threshold being increased from $2,500 to $5,000 as one of the measures released by the government to provide some relief for businesses affected by COVID-19. But what […]

read more -

Payroll Deductions

There are a number of statutory deductions an employer has to make from their employees pay. These are shown on the employees payslip. Below we discuss some of the common deductions and how they are […]

read more -

Accounting For Franchises

Franchise accounting is similar to accounting for other businesses, however there are some aspects which are unique to franchises. Understanding how a franchise is managed and implementing strategies which suit and grow the business will […]

read more -

Should you buy a franchise?

What’s a franchise? Franchise is acquiring the right to use another party’s proprietary knowledge, processes, and trademarks to sell a product or provide a service. Franchising is a good way for franchisors to expand and […]

read more -

Types and Rates of Taxes in New Zealand

New Zealand has various types of taxes. Some of these are widely known such as goods and services tax (GST) while taxes such as fringe benefit tax (FBT) might not be that popular. There are […]

read more -

Goods and Services Tax

GST is imposed and administered by the Goods and Services Tax Act 1985. GST was introduced in New Zealand on 1 October 1986 at a rate of 10% on most goods and services. It replaced […]

read more -

Get paid faster….

Maintaining a good cashflow is important for all businesses. However for small business this can be the key to survival. This is particularly important for small businesses in the post Covid environment. Below we discuss […]

read more -

Direct Debit

Direct debit systems have been around for a long time. However, until recently, they have been too expensive for small businesses to implement. Now with online providers and easy to use applications direct debit systems […]

read more -

Employing your Spouse/Partner

We have recently come across some cases where sole traders have unknowingly been employing and paying their spouse/partner from their business. This is fine as long as you’re a registered company and have registered as […]

read more -

Budget 2020 Summary

The 2020 Budget announced by the government on Thursday is the single biggest spending package in New Zealand’s history. It is a $50 Billion Covid-19 recovery budget aimed to keep New Zealand’s economy afloat while […]

read more -

Loss Offsets and Subvention Payments

In the current environment, businesses are looking for ways to minimize all costs including taxes. The government has introduced a temporary loss carry back scheme. However, some businesses may not be able to take advantage […]

read more -

Tax-free payment for working from home

IRD has made a determination (Determination EE002) regarding payments made by employers to their employees to reimburse costs incurred as a result of the employees working from home during the COVID-19 pandemic. This determination means […]

read more -

Temporary Loss Carry-Back Scheme

A temporary loss-carry back scheme has been legislated by the government as part of its COVID-19 response. The COVID-19 Response (Taxation and Other Regulatory Urgent Matters) Bill is the introduction of this temporary tax loss […]

read more -

Small Business Cashflow Loan Scheme

The government has unveiled an interest free loan scheme to assist small businesses impacted by the COVID-19 economic shock. It hopes this will meet the immediate cashflow needs of these businesses by helping them pay […]

read more -

Parliament Passes the Biggest Tax Support Package in New Zealand’s History

Reforms passed under urgency yesterday deliver the single biggest government support package to businesses via the tax system in modern New Zealand history. It will provide businesses with more than $3 billion in tax relief. […]

read more -

How to apply for the COVID-19 Government Wage Subsidy

As part of its Financial Support Package for businesses affected by COVID-19 the New Zealand government has allocated $5.1 Billion to a Wage Subsidy. This subsidy is available to all employers, sole traders and the […]

read more -

Governments Coronavirus Financial Package for Individuals & Businesses

The Government has unveiled a $12.1 Billion financial package to support small businesses, beneficiaries and the health sector through this crisis. The package is broken down as below: $5.1 Billion – Wage Subsidy $2.8 Billion […]

read more -

Changes coming to IRD from 1st April 2019

Some of the biggest changes to our tax system coming from 1st April 2019. Almost every taxpayer will be affected by these changes. Below we look at some of the changes coming in the next […]

read more -

Ring-fencing rental losses

IRD has released an issues paper on the proposal to change the rules of how losses from rental properties can be applied against other income. Under the proposed new rules these losses will be ring […]

read more -

Accident Compensation Corporation Levy (ACC)

ACC is something which is at the back of everyone’s minds that is until we get injured. Everyone (or almost everyone) know what ACC is, its insurance that covers you for accidents. However, like any […]

read more -

Minimum Wages changes from 1st April 2019

Minimum wages are set by the government and are reviewed every year. The current labour government committed to increase minimum wages to $20 per hour by 2021. The effect of this has been an increase […]

read more -

Tax Working Group - Final Report

Tax Working Group recommends introducing capital gains tax and reducing personal tax rate The final report by the Tax Working Group lead by Sir Michael Cullen came out today and unsurprisingly it recommended that the […]

read more

Chartered Accountant | Small Business Accountants in New Zealand

Blog

Contact Us

We would love to hear from you. Email, phone or connect with us via social media.

261 Morrin Road, St Johns, Auckland

Footer